The REAL value of the greenback is not reflected in the currency markets at present. The international community continues to support US toilet paper money only for fear of additional economic disruption; nevertheless, they will soon be forced to dump their worthless currency reserves lest they too be caught ‘short footed’ as some well-known banks that failed to dump their toxic credit ‘products’ have demonstrated!

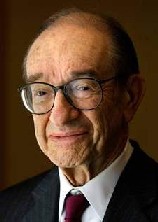

Alan 'Print'span

Hard reality dictates that the global economy is in dire straits and the end of capitalism, as we have unfortunately known it, is fast approaching. There is no avoiding the devastation and utter calamity that will beset the world around 2010 – forecasts indicate total economic ruination by that year!

However, some (prudent) nations will fare better than others – nations that cut their losses early and consolidate. The BRIC group of nations stand to fare better than most as they are essentially production/growth based economies with potentially large populations of consumers. It is a simple matter to increase the spending/saving power of those populations, which in turn would stimulate their overall economies – it is no accident that nations which favoured building their economies on sound economic principles will fare better than those that didn’t!

However, for the present ‘moment’ the toilet paper currency ‘standard’ retains some artificial value -- based on Fear NOT sound ECONOMIC PRINCIPLES!

The folly of allowing any nation to own a currency that becomes an international standard – is tantamount to issuing a license to steal! Recent history offers proof of the fact!

The international currency problem is easily remedied by a weighted index based on the three or four STRONGEST/PRODUCTIVE international economies. World currencies would be valued according to that INDEX, notwithstanding the ‘top four’ nations may change or alternate according to variants based on sound economic principles. A weighted index as opposed to a currency is the solution!

Capitalism has come of age and imploded in exactly the manner its direction indicated. Put simply, classical (regulated) capitalism is ‘wealth for the few’ and free market or laissez-faire capitalism is staggering wealth for the very few. Indeed the use of the word ‘staggering’ is apt as the sheer amount of wealth in the fewest possible hands effectively crushed/asphyxiated those in possession of it. Classical capitalism allowed for a more equitable distribution of wealth, which maintained some balance in the economy and allowed for the free flow of goods, services and IDEAS through a given community. Production was adequately supplied with the means to stimulate growth, DEVELOPMENT and INNOVATION! However, the laissez-faire model promoted theft, deception and racketeering, the full scale of which will soon be known.

America cannot avoid the devastating consequences of its reckless abuse of the economy and the greenback! Printing trillions on the demand of rogues engaged in an orgy of irresponsible spending and theft can only lead to de-valuation and ruination. Printing currency never compensates for sub-standard economic policy, as history clearly indicates!

The nations that reluctantly support the failed greenback today will soon be forced to dump their reserves -- the greenback has no where to go but down. A first year economics student could cite the very valid reasons why!

Dream on sheeple, dream while you can because it will soon be nightmare time! The nation at the centre of the economic storm continues on its delusional star-tangled path to oblivion! Today, G W Bush is arguing the ‘need’ to admit Croatia and Albania to NATO – who honestly gives a fuck, dubya? More inverted priorities from the worst administration in US history.

For those not aware of the thorough incompetence of the Bush regime, research for yourselves and discover that Rumsfeld, as Secretary of Defence, openly ADMITTED that he could not account for 2.3 TRILLION dollars of obviously stolen/misappropriated funds. That scandal would have brought down any government in the world but in the ‘home of the lame’ and ‘land of lobotomised,’ where entire elections are run on slogans and clichés -- not a skerrick of detail or policy -- would you expect otherwise?

So where do we go from here, Uncle? Whether the ‘executive’ creates another ‘emergency’ situation or not there is nowhere to go but down – the world is awake to the transparent tricks of the executive! The only population that would fooled is your own!

The world must of necessity soon dump the greenback, what then Uncle, another 9 ‘bullshit’ 11 or transparent anthrax attack? If you give the world no choice it would send you to the ‘rapture’ you so desperately seek. But why not, it is OBLIVION you unconsciously seek!

[2.3 Trillion dollars and yet the administration survives – unbelievable! ‘Only in America.’ Your only hope lies in arresting the entire group of neocons and holding them ALL to account for their many heinous crimes, but we know too well, you are not intellectually equipped or capable. No doubt the presidential elections will save you; Obama is a house slave/Uncle Tom, McCain and Biden are nuts and Palin is an air-head, PERFECT! A fate well-earned and deserved.]

http://au.youtube.com/watch?v=h9-tBGxVU6o&eurl

by Rex Nutting via rialator 2008-10-25 02:02:08

WASHINGTON (MarketWatch) -- Three current and former financial regulators told Congress on Thursday that they made fateful mistakes that helped drive the global financial system to the brink of disaster, and urged Congress to fill the regulatory gaps.

"We have learned that voluntary regulation does not work," said Christopher Cox, chairman of the Securities and Exchange Commission, in testimony on Thursday at the House Oversight and Government Reform Committee. "It was a fateful mistake" that no one was given the authority "to regulate investment bank holding companies other than on a voluntary basis."

Former Federal Reserve Chairman Alan Greenspan said he was "shocked" by the breakdown in the credit system and told Congress the crisis was once in a century.

Alan Greenspan testified that he still believes the "self-interest" of banks and other financial firms is the best protection against malfeasance, because both sides of the trade will police the other.

But, Greenspan said, he and others are in "a state of shocked disbelief" that "counterparty surveillance" failed.

"I made a mistake in presuming that the self-interests of organizations, specifically banks and others, were such as that they were best capable of protecting their own shareholders and their equity in the firms," Greenspan said.

The "solid edifice" of his de-regulatory philosophy "did break down," he said. "And I think that, as I said, shocked me. I still do not fully understand why it happened."

Self-interest was at the root of the crisis, said Rep. Henry Waxman, D-Calif., chairman of the oversight committee. "Corporate excess and greed enriched company executives at enormous cost to shareholders and our economy," Waxman said.

Greenspan said now he favors strengthening the regulatory structure. "As much as I would prefer it otherwise, in this financial environment I see no choice but to require that all securitizers retain a meaningful part of the securities they issue," Greenspan said.

Cox urged Congress to create a select committee made up of the ranking members of the several committees that have jurisdiction over financial institutions and markets to come up with "a new, overarching statutory scheme" to eliminate gaps in the regulations. Turf battles in Congress have led to the hodge-podge regulatory system, he said, speaking from experience as a 17-year veteran of the House.

The financial system exists to raise and direct the capital the economy needs to grow and "should not be an end in itself - a baroque cathedral of complexity dedicated to limitless compensation for itself in the short-term, paid for with long-term risk capable of threatening the entire nation's sustenance and growth," Cox said.

Rep. John Mica, R-Fla., tried to turn the hearing into an examination of the role that Fannie Mae and Freddie Mac played in creating the subprime mortgage market, but Waxman told him that the committee would examine Fannie and Freddie later.

Former Treasury Secretary John Snow said he warned early and often about the risks posed by Fannie and Freddie's implicit backing by the government. "I regret I wasn't more effective in trying to persuade Congress of the need for action to deal with the risks that I saw as the largest and -- and most visible systemic risk at the time," Snow said.

Republican leaders have said that risky lending by Fannie and Freddie, with the support of the Democrats in Congress, were the major causes of the subprime crisis.

"This is a political argument, not a factual one," Waxman said. To argue that Fannie and Freddie caused the problem "makes as much sense as saying offshore drilling will solve our energy problems," he said.

http://www.marketwatch.com/