A "second wave" of countries will fall victim to the economic crisis and face being bailed out by the International Monetary Fund, its chief warned at the G7 summit in Rome. [IMF chief] Dominique Strauss-Kahn's warning comes amid growing concern that at some point in the next year a major economy could have to seek support from the Fund. Mr Strauss-Kahn, who was yesterday attending the Group of Seven leading finance ministers' meeting in Rome, said: "I expect a second wave of countries to come knocking."

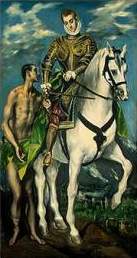

Affluent and beggar: why tolerate a two-tier society?

The IMF managing director also said the rich world was now in the midst of a "deep recession". It came as the G7 pledged to avoid slipping into protectionism and repeating the same political and economic mistakes as were made in the 1930s. Ministers also pledged to do more to support their banking systems, sparking speculation that a number of countries, including Germany and France, will unveil new bail-outs and possibly set up "bad banks" as they scramble to fight the crisis.

But with some countries' economies effectively dwarfed by the size of their banking sector and its financial liabilities, there are fears they could fall victim to balance of payments and currency crises, much as Iceland did before receiving emergency assistance from the IMF last year.

Some have speculated that the UK may have to seek IMF support if capital markets become frightened of the size of its foreign financial liabilities, which increasingly appear to have become supported by the state. But there are a swathe of Eastern European countries which appear particularly vulnerable and may need IMF support.

With the Fund's warchest expected to run dry later this year, the Japanese confirmed in Rome that they would supply an extra $200bn of capital to the Washington-based institution.

Mr Strauss-Kahn, who warned recently that his resources could run dry within six months, said: "This is the largest loan ever made in the history of humanity.

"The biggest concrete result of this summit is the loan by the Japanese... now I will continue with the objective of doubling the Fund's resources."

He added that it was now essential for countries to support their banking sectors.

© 2009 Telegraph Media Group Limited

http://tinyurl.com/ac6kee

by Ulrich Rippert via rialator 2009-02-17 01:30:44

Statistics released Thursday by the European Union's Eurostat agency reveal that production plummeted across Europe at the end of 2008. The figures announced were far worse than analysts had anticipated. Industrial production declined across Europe by 2.6 percent in December compared to the previous month. On a year-to-year basis, European production has slumped 12 percent.

For some time, leading European politicians have attempted to put a positive gloss on declining figures for European production, but the results released Thursday ushered in a new tone. European Union Industry Commissioner Günter Verheugen told the Financial Times Deutschland, "The extent and speed of the crisis is completely new."

One day previously, an Ifo Institute for Economic Research survey revealed that business sentiment within the 16-country common-currency eurozone declined for the sixth consecutive quarter, plunging to its lowest point since the survey began 16 years ago. The European Central Bank (ECB) also issued a warning that the recession gripping Europe will not be short-lived. Rather, it will be a "long-lasting and clear downturn," the ECB said.

The response of the individual European nations to the growing crisis has been to embrace a raft of protectionist measures. Italian Premier Silvio Berlusconi recently warned appliance maker Indesit SpA not to transfer production and jobs to Poland, and in Britain, trade unions and politicians are demanding "British jobs for British workers."

On Wednesday, the acting EU Council president, Czech Prime Minister Mirek Topolanek, appeared before the press in Brussels and warned of a "protectionist race" in Europe, while acknowledging that national economies in the European Union were being hit hard by the international crisis and losing ground with unanticipated speed.

Topolanek said, "Problems are emerging in the wake of the economic and financial crisis which the European Union considered to be relics of the past century and long since solved."

After a meeting with EU Commission President José Manuel Barroso, Topolanek described the situation in Europe "as worse than it has ever been." The confidence of citizens in the economic and political system had been shaken, he said, and warned that the battening down of national markets endangered the European domestic market and the world economy.

The Süddeutsche Zeitung echoed the statements of the EU Council president, writing, "Any politician seeking to solve the economic crisis by protectionist measures only worsens the situation."

Barroso also warned against states going it alone. European heads of state and government should put an end to any "nationalist navel gazing," he said. Otherwise, there was a danger of "intensifying the powerful downward trend."

The European automotive industry is being especially hard hit by the lack of credit. A European Union analysis stated: "Broad access to credit plays an important role in the automotive industry, with between 60 and 80 percent of private car sales in Europe carried out on a credit basis." In the steel industry, European Commission experts have reported a slump in orders of 43 to 57 percent.

The European Union leadership expects a sharp rise in the number of unemployed in the coming months. According to EU Industry Commissioner Verheugen, in the past four months companies have shed 158,000 jobs and created just 25,000 new jobs. This is a reversal of the first three quarters of 2008, which saw a general trend toward increased employment.

Last Wednesday, the French automaker Peugeot announced it was shedding at least 11,000 jobs, and one day later, Renault announced its own plans to cut its workforce by 9,000. These job cuts have been agreed to by the French government and trade unions and are bound up with the announcement by French President Nicolas Sarkozy that he plans to subsidise domestic automakers with the sum of €6 billion.

Sarkozy declared that, in his opinion, it was irresponsible "to continue to manufacture French cars in the Czech Republic." He demanded a halt to the transfer of production to other countries. "If we give financial aid to the automotive industry," he said, "we do not want them to set up a factory in the Czech Republic again." He also urged the carmakers to support French industries involved in supplying parts and services to French auto companies.

Czech Prime Minister Topolanek reacted sharply to this openly protectionist policy and called for a special European summit to block it and similar policies.

German Chancellor Angela Merkel (Christian Democratic Union—CDU) also criticised the French action. The defence of free trade and the European domestic market is of crucial importance, Merkel said.

The German economy, which is heavily dependent on its export industries, would be especially vulnerable to any growth of protectionist measures in Europe.

Sarkozy defended his decision and drew attention to the fact that the German chancellor had rejected a joint European stimulus programme just a few weeks before. Now, every government was forced to take its own measures to deal with the crisis, he said. He added that the latest German stimulus programme includes many measures aimed at subsidising German enterprises.

The conflict between Berlin and Paris runs deep. In his role as EU Council president last year, Sarkozy repeatedly raised the demand for an "economic administration" for the eurozone. He made it quite clear that he regarded himself as best suited to head such an administration.

Supported by a majority of the 16 eurozone countries, Sarkozy is seeking to compel the German government to take more responsibility for financial policy. According to the Élysée Palace, Germany, as the continent's biggest national economy, must contribute much more to managing the crisis.

The German government wants precisely to prevent such a development. It regards itself better prepared for the crisis than other euro countries due to the labour market reforms introduced by the previous Social Democratic-Green government, which slashed welfare payments and opened the way for the creation of a huge low-wage sector in Germany.

Backed by the country's business federations, the Merkel government is seeking to exploit the crisis to strengthen Germany's dominant role in Europe. Berlin is vehemently opposed to taking any responsibility for Europe's "weak states"—i.e., those countries that have thus far failed to implement drastic social and welfare cuts.

Behind the German chancellor's appeals for adherence to "free trade" and rejection of protectionism lie the egoistic interests of the German business elite, which profits most from the European domestic market.

The varying economic performances of individual euro countries and the absence of a uniform financial and economic policy have led to increasing discrepancies ("spreads") between the government loans of the euro countries. In mid-January, Greece had to take out a new government loan at an interest rate well above the 3 percent levied on German government securities. Financial experts have said that the trend of rising spreads has "definitely not stopped" and warn that it could have explosive consequences for the fate of the euro as a common currency.

When the chairman of the euro group, Luxembourg Finance Minister and Prime Minister Jean-Claude Juncker, suggested introducing eurobonds to allow weaker member states access to credit on the basis of a pan-European solution, his proposal was immediately rejected by German Finance Minister Peer Steinbrück (Social Democratic Party—SPD). Instead, the German government is seeking to use its EU industry commissioner, Günter Verheugen, to force member states to implement budget cuts and strict austerity policies.

In view of increasing tensions, the EU presidency and the European Commission have announced plans for no fewer than three separate summits in the coming three months. On March 1, the heads of state and government will meet in Brussels to "coordinate national stimulus packages." The agenda is to include the struggle against protectionist tendencies, measures to revive the circulation of credit, the handling of "toxic" securities, and policies directed against the rise of unemployment. Three weeks later, the regular spring summit of the EU takes place in Brussels, which is also likely to concentrate on the economic and financial crisis. In May, the Czech council president has invited member countries to Prague for an employment summit.

Behind this summit frenzy are fears of a possible break-up of the European Union and increasing social unrest, as nations face mass unemployment and growing poverty.

© 2009 Ulrich Rippert, Global Research

http://www.globalresearch.ca/index.php?context=va&aid=12314