|

The ‘Amero’ -- fact or fiction?

by Sonya Rehman via quin - Saturday Post Wednesday, Feb 4 2009, 9:24am

international /

miscellaneous /

other press

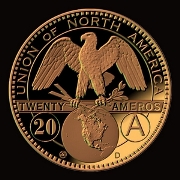

Word has it that the US Dollar is soon to be replaced by the ‘Amero’. Is this just another conspiracy theory kicked up by a bunch of bored conspiracy theorists?

Who knows, but at the rate the US economy finds itself sinking further into a quicksand recession, the introduction of the Amero might just turn out to be a reality.

And this brings us to the North American Union (NAU). So what exactly is the NAU? The NAU apparently brings together the United States, Canada and Mexico under one umbrella – with the eradication of each country’s borders - to allow free trade, in addition to the free entry and exit of people residing in the three aforementioned countries.

The NAU, infact, is quite like the European Union, which too, follows an agenda which is absolutely globalized: one system, one currency - where the US Dollar, Canadian Dollar and the Mexican Peso will be replaced by the Amero.

But the Western media, for reasons unknown, hasn’t really addressed the NAU and the Amero.

During my online research, I found that well-known publications such as The Washington Post, The New York Times, Newsweek and TIME failed to carry any sort of newsbyte, article or column addressing this conspiracy theory (or imminent reality).

Drake Bennett of The Boston Globe is perhaps the only credible journalist (whose article I sourced online) who published an article in November 2007 about the entire Amero conspiracy.

Bennett, in his article states: “If you haven't heard about the NAU that may be because its plotters have succeeded in keeping it secret. Or, more likely, because there is no such thing. Government officials say a continental union is out of the question, and economists and political analysts overwhelmingly agree that there will not be a North American Union in our lifetimes. But belief in the NAU - that the plans are very real, and that the nation is poised to lose its independence - has been spreading from its origins in the conservative fringe, colouring political press conferences and candidate question-and-answer sessions, and reaching a kind of critical mass on the campaign trail.”

Another website claimed that the US had shipped 800 billion Ameros to China to cover its debt obligation!

Could all of this really be hearsay? An interesting 2006 report titled ‘Analysts: Dollar collapse would result in Amero’ (up on a number of websites and e-zines) quotes Bob Chapman (a financial newsletter writer): “People in the US are going to be hit hard,” Chapman warned. “In the severe recession we are entering now, Bush will argue that we have to form a North American Union to compete with the Euro.” “Creating the Amero”, Chapman explained, “will be presented to the American public as the administration's solution for dollar recovery. In the process of creating the Amero, the Bush administration just abandons the dollar.”

A reporter/commentator working for CNN, Lou Dobbs officially stated that the foundation for the NAU – a borderless nation - is in actuality, being set without the approval of the hundreds and millions of citizens that will be affected by it.

Wikipedia covers the Amero conspiracy quite extensively. For instance, the website claims that in 2001, the results of a poll in Quebec affirmed that while “over 50 percent of respondents favoured the idea of a shared currency”; the rest opposed the notion of a common currency.

Mexico, on the other hand quite interestingly (as stated by Wikipedia) supports the notion: “Former Mexican President Vincente Fox echoed that view and expressed his hope for a greater integration of Canada, Mexico and the United States, including an eventual monetary union while on a 2007 promotional tour for his book ‘Revolution of Hope’”.

Why the Amero conspiracy may just turn out to be a farce is because the creation of one system – uniting the economies of America, Canada and Mexico – will transfer the reign of power into the palms of America. And this might not go down well with Canada and Mexico as then; both countries would have to forgo economic independence in addition to America tapping into Mexico and Canada’s natural resources.

The words of caution coming by way of American scholars, writers and journalists whilst the American economy plummets further down the growth curve into heavy-duty decline, can’t help but make one wonder and feel perhaps, slightly suspicious about the Amero conspiracy actually becoming a hard-hitting truth.

This is because the greatest superpower in the world – the United States of America – finds itself in an economic malaise, one that can be juxtaposed with the Great Depression of the 1930s.

While some conspiracy theories remain riddled with loop-holes, others stand in a quivery state of stagnation – waiting to be proven and/or negated.

From the New World Order, underground secret societies, and now the NAU, one wonders what the truth really is regarding the latter.

Could the NAU and the introduction of the Amero be a looming reality – introduced just in time to save the American economy from the shambles?

Or, could it simply be another one of those batty conspiracy theories, feeding on one’s paranoia…which, with time, will eventually be swept under the rug?

Copyright applies.

http://www.thesaturdaypost.com/community_165_amero.htm COMMENTS show latest comments first show comment titles only

jump to comment 1

2

Dollar: a conspiracy theory

by RT staff report via reed - Russia Today Wednesday, Feb 4 2009, 9:35am

While the world economy collapses the American dollar continues to strengthen its position in the world, to little wonder – it’s getting back to its basics as the backup currency on every continent except Antarctica.

Yet since the U.S. has debts two times exceeding the world’s GDP one cannot help but ask oneself – what’s next?

The web is flooded with lots of theories and rumours about what would happen to the American currency whether, when and where it would fall – or what else. Some of them look like senseless fantasies, others resemble futurologist’s predictions, but the conspiracy theories of all kinds and colours are firmly on top of all.

“Dollar will crash soon”, “U.S. will change currency”, “Dollars will be sold by weight” – as some smart Russian blogger put it – who creates such buzz and is there a rational reason for the slightest of anxieties?

Well, there is a fact that poses a question, with a big Q. Dollar monetary stock worldwide has grown two-fold over the last half-year and this printing press does not seem to be slowing down. [Emphasis added.]

Would this financial pyramid eventually collapse (since these lots of green paper are not based neither on gold or something equally solid nor collateralized to be collateral)? No one from the U.S. Federal Reserve System so far has intelligibly explained what they are planning to do with the paper, and this mystery probably holds the key answer to the question posed above.

The unimaginable trillions of dollars of national debt make the currently realised $US 700 billion bailout plan look pale in comparison – as well as the $US 850 billion next one currently being discussed.

The truth is that all this money just does not exist. You can print banknotes but you cannot necessarily call them “money”. Imagine this money distributed equally among every living person and fancy what would happen if they all decided to buy goods simultaneously – there’d not be enough goods on this planet. What’s next? Guess for yourself.

So, the devaluation of the dollar is probably not far away but what could happen before this event? Here are just some of the most fabulous yet entirely possible worst-case scenarios.

Option 1. Have you heard about Amero? Not yet?! Well, that’s how most probably will be called the currency of the united economic zone of the U.S., Canada and Mexico. Unimaginable? You’d better imagine what to do with the green paper stockpiled throughout the world if the exchange rate is 1:10 or even 1:100.

Option 2. This world is infested with forgers and false dollars (most of them not in the U.S.) When the hour comes and the new (let’s say red) dollar is produced, all the rest of the world would face the problem of how to use the green ones. Beware! The print is toxic and you’d die anyway when trying to burn them in your fireplace once you survive the heart attack of hearing the news itself.

Option 3. Everyone knows that the U.S. is a cheap country. Americans do not hellishly spend popular $US 100 banknotes as often as the rest of us. No use – no need. Why don’t they call them off altogether? They are nearly all false, anyway.

Option 4. The U.S. declares itself technically bankrupt. Impossible? There are RULES, you’d say? Everything’s possible for the country that has changed the rules of the game countless times to become the biggest consumer sponging on the rest of the world.

Option 5. Uncontrollable printing of the dollar banknotes alone would collapse the dollar system that would make the debt returning for the U.S. Federal Reserve System a task somehow much easier than it is nowadays.

There are economists that do hope that a number of regional unified currencies would emerge within the near future in Asia, Latin America, and Arab world, and even among post-Soviet countries. The euro is a spectacular example, but you do not need to be an economist to understand that such processes expand for decades (consider again the euro example) while the crisis has already stepped in and mushroomed as straight and tall as an atomic cloud.

That is why the more probable seems an Option 6, which is a good old receipt when some countries are busy exterminating each other’s population while the other countries are just accepting arms contracts from both warring parties. Just keep in mind we live in a nuclear age. Again unthinkable? Than take a closer look at the Islamist-torn Pakistan and India and their relations after the Mumbai massacre. Nuclear weapons? They have them both.

If they wage war against each other, they’d be no such thing as Asian, Arab or even European financial markets at all and nobody would care what the hell happened to the dollar.

© 2009 TV-Novosti

http://www.russiatoday.com/features/news/36658

Runaway Wall Street

by Robert Scheer via reed - Truthdig.com Wednesday, Feb 4 2009, 9:51am

It is instructional that only one of the three tax-challenged Obama appointees has survived public scorn to claim a high position in the new administration. Oddly enough, it is Treasury Secretary Timothy Geithner, the man who will collect our taxes, whose career has not been stunted by his failure to pay them.

What makes Geithner so special? The answer, provided by everyone from the president to the media pundits, is that his services are indispensable because he has the expertise in regulating markets needed to preside over the most massive government intervention in the economy. Are they kidding?

Both in his years in the Clinton Treasury and as chair of the New York Federal Reserve Bank, Geithner has been paving the way for a runaway Wall Street. Nor has he changed his ways, as was evidenced once again last week with his appointment of Mark Peterson, a Goldman Sachs vice president and lobbyist, to be his top aide. Peterson had lobbied strenuously for precisely the deregulation that the Obama administration now concedes needs reversing. It was confirmation that Goldman Sachs runs the Treasury Department—no matter which party is in power.

Last October The New York Times ran a devastating story entitled “The Guys From ‘Government Sachs,’ ” spotlighting the many Goldman Sachs alums operating under the firm’s former head, Henry Paulson, after he was named Treasury secretary. The problem is that Geithner, whom Obama appointed as Paulson’s replacement, was totally enmeshed in Paulson’s handout to Wall Street while chair of the New York Fed. In that capacity, Geithner was intimately involved in the highly questionable negotiations to bail out AIG, in which Goldman had a $20 billion partnership at risk.

Goldman Sachs CEO Lloyd C. Blankfein was present for those rushed and highly guarded weekend meetings, which resulted in an initial $85 billion bailout for AIG and has since grown to $122 billion. As The Times reported, “Mr. Paulson helped select a director form Goldman’s own board to lead AIG.” That decision to save AIG came after the New York Fed, led by Geithner, summarily spurned requests to save Goldman competitor Lehman Brothers. While he opposed Lehman’s attempt to reconstitute as a bank holding company and therefore obtain federal financing, he later supported a similar request by Goldman Sachs.

Another major player in those machinations was Robert Rubin, who headed Goldman Sachs before becoming Treasury secretary under Clinton and who pushed for the radical deregulation that is at the center of the banking crisis. Geithner was a protégé of Rubin’s in that effort, as was Lawrence Summers, who went on to be Clinton’s Treasury secretary after Rubin moved on to head Citigroup. Regrettably, Summers is now the key White House economics adviser.

Rubin, Geithner and Summers are hell-bent on denying the responsibility of their deregulation initiatives for the economic crisis. But the reality is that the merger of investment and commercial banks with insurance companies and stock brokers was illegal before the approval of their legislation, which reversed the Glass-Steagall Act passed under Franklin Delano Roosevelt. So, too, the newfangled financial instruments were exempted from any government regulation, thanks to the Commodity Futures Modernization Act that Summers got Clinton to sign into law a month before he left office.

The reversal of Glass-Steagall unleashed the robber barons, as was freely conceded by Goldman CEO Blankfein in an interview he gave to The New York Times in June 2007. “If you take an historical perspective,” Blankfein said, gloating back then about the vast expansion of Goldman Sachs, “we’ve come full circle, because that is exactly what the Rothchilds or J.P. Morgan the banker were doing in their heyday. What caused an aberration was the Glass-Steagall Act.”

The “aberration” being the sensible regulation of Wall Street to prevent another depression, which now seems dangerously close at hand. Since Glass-Steagall was repealed in 1999, Goldman Sachs experienced a 265 percent growth in its balance sheet, totaling $1 trillion in 2007.

What we need is an honest accounting of how we got into this mess, beginning with an investigation of the role of Goldman Sachs as the most insidious Wall Street player. But we are not likely to get that from an administration populated by Goldman’s Washington allies.

On Tuesday, new Attorney General Eric Holder assured Wall Street that “We’re not going to go out on any witch hunts.” But what if the once-celebrated financial wizards, still allowed to dominate our economic policies, are indeed wicked witches?

© 2009 Truthdig, LLC

http://www.truthdig.com/report/item/20090204_runaway_wall_street/

<< back to stories

|