|

Irresponsible currency printing certain to annihilate greenback

by nano Saturday, Oct 25 2008, 1:37am

international /

social/political /

opinion/analysis

The REAL value of the greenback is not reflected in the currency markets at present. The international community continues to support US toilet paper money only for fear of additional economic disruption; nevertheless, they will soon be forced to dump their worthless currency reserves lest they too be caught ‘short footed’ as some well-known banks that failed to dump their toxic credit ‘products’ have demonstrated!

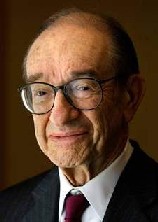

Alan 'Print'span

Hard reality dictates that the global economy is in dire straits and the end of capitalism, as we have unfortunately known it, is fast approaching. There is no avoiding the devastation and utter calamity that will beset the world around 2010 – forecasts indicate total economic ruination by that year!

However, some (prudent) nations will fare better than others – nations that cut their losses early and consolidate. The BRIC group of nations stand to fare better than most as they are essentially production/growth based economies with potentially large populations of consumers. It is a simple matter to increase the spending/saving power of those populations, which in turn would stimulate their overall economies – it is no accident that nations which favoured building their economies on sound economic principles will fare better than those that didn’t!

However, for the present ‘moment’ the toilet paper currency ‘standard’ retains some artificial value -- based on Fear NOT sound ECONOMIC PRINCIPLES!

The folly of allowing any nation to own a currency that becomes an international standard – is tantamount to issuing a license to steal! Recent history offers proof of the fact!

The international currency problem is easily remedied by a weighted index based on the three or four STRONGEST/PRODUCTIVE international economies. World currencies would be valued according to that INDEX, notwithstanding the ‘top four’ nations may change or alternate according to variants based on sound economic principles. A weighted index as opposed to a currency is the solution!

Capitalism has come of age and imploded in exactly the manner its direction indicated. Put simply, classical (regulated) capitalism is ‘wealth for the few’ and free market or laissez-faire capitalism is staggering wealth for the very few. Indeed the use of the word ‘staggering’ is apt as the sheer amount of wealth in the fewest possible hands effectively crushed/asphyxiated those in possession of it. Classical capitalism allowed for a more equitable distribution of wealth, which maintained some balance in the economy and allowed for the free flow of goods, services and IDEAS through a given community. Production was adequately supplied with the means to stimulate growth, DEVELOPMENT and INNOVATION! However, the laissez-faire model promoted theft, deception and racketeering, the full scale of which will soon be known.

America cannot avoid the devastating consequences of its reckless abuse of the economy and the greenback! Printing trillions on the demand of rogues engaged in an orgy of irresponsible spending and theft can only lead to de-valuation and ruination. Printing currency never compensates for sub-standard economic policy, as history clearly indicates!

The nations that reluctantly support the failed greenback today will soon be forced to dump their reserves -- the greenback has no where to go but down. A first year economics student could cite the very valid reasons why!

Dream on sheeple, dream while you can because it will soon be nightmare time! The nation at the centre of the economic storm continues on its delusional star-tangled path to oblivion! Today, G W Bush is arguing the ‘need’ to admit Croatia and Albania to NATO – who honestly gives a fuck, dubya? More inverted priorities from the worst administration in US history.

For those not aware of the thorough incompetence of the Bush regime, research for yourselves and discover that Rumsfeld, as Secretary of Defence, openly ADMITTED that he could not account for 2.3 TRILLION dollars of obviously stolen/misappropriated funds. That scandal would have brought down any government in the world but in the ‘home of the lame’ and ‘land of lobotomised,’ where entire elections are run on slogans and clichés -- not a skerrick of detail or policy -- would you expect otherwise?

So where do we go from here, Uncle? Whether the ‘executive’ creates another ‘emergency’ situation or not there is nowhere to go but down – the world is awake to the transparent tricks of the executive! The only population that would fooled is your own!

The world must of necessity soon dump the greenback, what then Uncle, another 9 ‘bullshit’ 11 or transparent anthrax attack? If you give the world no choice it would send you to the ‘rapture’ you so desperately seek. But why not, it is OBLIVION you unconsciously seek!

[2.3 Trillion dollars and yet the administration survives – unbelievable! ‘Only in America.’ Your only hope lies in arresting the entire group of neocons and holding them ALL to account for their many heinous crimes, but we know too well, you are not intellectually equipped or capable. No doubt the presidential elections will save you; Obama is a house slave/Uncle Tom, McCain and Biden are nuts and Palin is an air-head, PERFECT! A fate well-earned and deserved.]

http://au.youtube.com/watch?v=h9-tBGxVU6o&eurl COMMENTS show latest comments first show comment titles only

jump to comment 1

2

3

'Regulators' say they made fateful mistakes

by Rex Nutting via rialator - Market Watch Saturday, Oct 25 2008, 2:02am

WASHINGTON (MarketWatch) -- Three current and former financial regulators told Congress on Thursday that they made fateful mistakes that helped drive the global financial system to the brink of disaster, and urged Congress to fill the regulatory gaps.

"We have learned that voluntary regulation does not work," said Christopher Cox, chairman of the Securities and Exchange Commission, in testimony on Thursday at the House Oversight and Government Reform Committee. "It was a fateful mistake" that no one was given the authority "to regulate investment bank holding companies other than on a voluntary basis."

Former Federal Reserve Chairman Alan Greenspan said he was "shocked" by the breakdown in the credit system and told Congress the crisis was once in a century.

Alan Greenspan testified that he still believes the "self-interest" of banks and other financial firms is the best protection against malfeasance, because both sides of the trade will police the other.

But, Greenspan said, he and others are in "a state of shocked disbelief" that "counterparty surveillance" failed.

"I made a mistake in presuming that the self-interests of organizations, specifically banks and others, were such as that they were best capable of protecting their own shareholders and their equity in the firms," Greenspan said.

The "solid edifice" of his de-regulatory philosophy "did break down," he said. "And I think that, as I said, shocked me. I still do not fully understand why it happened."

Self-interest was at the root of the crisis, said Rep. Henry Waxman, D-Calif., chairman of the oversight committee. "Corporate excess and greed enriched company executives at enormous cost to shareholders and our economy," Waxman said.

Greenspan said now he favors strengthening the regulatory structure. "As much as I would prefer it otherwise, in this financial environment I see no choice but to require that all securitizers retain a meaningful part of the securities they issue," Greenspan said.

Cox urged Congress to create a select committee made up of the ranking members of the several committees that have jurisdiction over financial institutions and markets to come up with "a new, overarching statutory scheme" to eliminate gaps in the regulations. Turf battles in Congress have led to the hodge-podge regulatory system, he said, speaking from experience as a 17-year veteran of the House.

The financial system exists to raise and direct the capital the economy needs to grow and "should not be an end in itself - a baroque cathedral of complexity dedicated to limitless compensation for itself in the short-term, paid for with long-term risk capable of threatening the entire nation's sustenance and growth," Cox said.

Rep. John Mica, R-Fla., tried to turn the hearing into an examination of the role that Fannie Mae and Freddie Mac played in creating the subprime mortgage market, but Waxman told him that the committee would examine Fannie and Freddie later.

Former Treasury Secretary John Snow said he warned early and often about the risks posed by Fannie and Freddie's implicit backing by the government. "I regret I wasn't more effective in trying to persuade Congress of the need for action to deal with the risks that I saw as the largest and -- and most visible systemic risk at the time," Snow said.

Republican leaders have said that risky lending by Fannie and Freddie, with the support of the Democrats in Congress, were the major causes of the subprime crisis.

"This is a political argument, not a factual one," Waxman said. To argue that Fannie and Freddie caused the problem "makes as much sense as saying offshore drilling will solve our energy problems," he said.

http://www.marketwatch.com/

Alan Greenspan: Public Enemy Number One

by Stephen Lendman via reed - Global Research Monday, Oct 27 2008, 11:43pm

lendmanstephen@sbcglobal.net

A note before beginning. This article focuses on today's financial and economic crisis. Not affairs of state, war and peace or geopolitics. No guessing who's number one under those headings. That said:

With so many good choices, it's hard just picking one. But given the gravity of today's financial crisis, one name stands out above others. The "maestro," as Bob Woodward called him in his book by that title. The "Temple of Boom" chairman, according to a New York Times book review. Standing "bestride the Fed like a colossus." Now defrocked as the "maestro" of misery. Alan Greenspan. From August 11, 1987 to January 31, 2006, as head of the private banking cartel euphemistically called the Federal Reserve. That Ron Paul explains isn't Federal and has no reserves.

It represents bankers who own it. Big and powerful ones. Not the state or public interest. It prints money. Controls its supply and price. Loans it out for profit and charges the government interest it wouldn't have to pay if Treasury instead of Federal Reserve notes were issued. People, as a result, pay more in taxes for debt service. The nation is more crisis-prone. Over time they increase in severity. The current one the most serious since the Great Depression. Potentially the greatest ever. The result of Greenspan's 18 year irresponsible legacy.

He championed deregulation and presided over an earlier version of today's crisis. The Reagan-era savings and loan fraud. It bankrupted 2200 banks. Cost taxpayers around $200 billion and for many people their savings in S & Ls they thought safe.

In the 1990s, he engineered the largest ever stock market bubble and bust in history through incompetence, subservience to Wall Street, and dereliction of duty. In January 2000, weeks short of the market peak, he claimed that "the American economy was experiencing a once-in-a-century acceleration of innovation, which propelled forward productivity, output, corporate profits, and stock prices at a pace not seen in generations, if ever....Lofty stock prices have reduced the cost of capital. The result has been a veritable explosion of spending on high-tech equipment....And I see nothing to suggest that these opportunities will peter out anytime soon....Indeed many argue that the pace of innovation will continue to quicken....to exploit the still largely untapped potential for e-commerce, especially the business-to-business arena."

A week later, the Nasdaq peaked at 5048. Lost 78% of its value by October 2002. The S&P 500 49% from its March 2000 high to its October 2002 bottom. Individual investors were left high and dry as a result. For Mr. Greenspan, it was back to engineering multiple bubbles with 1% interest rates and a tsunami of easy money.

He advocated less regulation, not more. Voluntary oversight. The idea that markets work best so let them. Government intervention as the problem, not the solution. In the mid-1990s, he told a congressional committee:

"Risks in financial markets, including derivative markets, are being regulated by private parties. There is nothing involved in federal regulation per se which makes it superior to market regulation."

On October 23 before the House Government Oversight and Reform committee, he refused to accept blame for the current crisis, but softened his tone and admitted a "flaw" in his ideology. Confessed his faith in deregulation was shaken. Said he was in a "state of shocked disbelief." Unclear on what went wrong. Not sure "how significant or permanent it is," and added:

-- "We are in the midst of a once-in-a century credit tsunami (requiring) unprecedented measures;"

-- "This crisis has turned out to be much broader than anything I could have imagined;"

-- "fears of insolvency are now paramount;"

-- significant layoffs and unemployment are ahead;

-- a "marked retrenchment of consumer spending" as well;

-- containing the crisis is conditional on stabilizing home prices;

-- at best, it's "still many months in the future;"

What went wrong with policies that "worked so effectively for nearly four decades," he asked? Securitizing home mortgages. "Excess demand" for them, and failure to properly price them he answered. Unmentioned was unbridled greed. The greatest ever fraud. No oversight, and a predictable crisis only surprising in its magnitude and how it grew to unmanageable severity.

Greenspan is now softening on regulation but barely enough to matter. Too little, too late by any standard, and only to restore stability after which chastened investors "will be exceptionally cautious." In the end, in his view, "This crisis will pass, and America will reemerge with a far sounder financial system." Until another Fed chairman repeats his mistakes. Creates a crisis too big to contain. Destroys unfettered capitalism as we know it. Changes the world irrevocably as a consequence. Unless this time is the big one and does it sooner.

In March 1999, Greenspan was optimistic at the end of a robust decade (that James Petras calls "the golden age of pillage") with no worries about new millennium meltdowns. He addressed the Futures Industry Association and said it would be "a major mistake" to increase rules on how banks assess risks when they use derivatives. He added: "By far the most significant event in finance during the past decade has been the extraordinary development and expansion of financial derivatives." By a compounded 20% rate throughout the decade. Around 30% alone by banks in 1998. And, according to Greenspan, "The reason that (derivatives) growth has continued despite adversity, or perhaps because of it, is that these new financial instruments are an increasingly important vehicle for unbundling risk....the value added of derivatives themselves derives from their ability to enhance the process of wealth creation (and) one counterparty's market loss is the (other's) gain."

Overall, they've increased the standard of living of people globally, he claimed. In fact, they contributed to global crises in the 1990s. Hot money in, and meltdowns when it exited. The problem is derivatives work well in bull markets, but are disastrous when they're down. Going up they do nothing for ordinary people, but during downturns receding tides sink all boats and all in them and aren't the zero sum game Greenspan suggested.

Worst of all are so-called credit default swaps (CDSs). The most widely traded credit derivative. In the tens of trillions of dollars. A $43 trillion market, according to PIMCO's Bill Gross. The International Swaps and Derivatives Association (ISDA) estimates it at $54.6 trillion. Down from $62 trillion at yearend 2007. Others place it higher, but key is what they are and how they're used. They resemble insurance (on risky mortgages), but, in fact, are for little more than casino-type gambling. Unregulated with no transparency in the shadow banking system that dwarfs the traditional one in size and risk.

Gross describes it this way. It "craftily dodges the reserve requirements of traditional institutions and promotes a chain letter, pyramid scheme of leverage, based in many cases on no reserve cushion whatsoever." CDSs are at the center of shadow banking, and Gross and others warn about possible financial Armageddon if things begin collapsing.

A "Cheerleader for Imprudence"

That, according to James Grant, editor of Grant's Interest Rate Observer. Greenspan's "biggest mistake was inciting people to do imprudent things." He called him "marble-mouthed" for his "Greenspeak" and not simply admitting he "was as blind as those (he) pretended to lead. This sense of security that people invested in the idea of perfect control by an all-knowing brain at the top, that idea's been shattered."

In July, Grant was outspoken in a Wall Street Journal op-ed titled "Why No Outrage?" He quoted Mary Elizabeth Lease from the Populist era haranguing farmers to "raise less corn and more hell." He asked why today's financial victims aren't protesting Fed policy "of showering dollars on the (monied) people who would seem to (least) need them." Where are the "uncounted improvident?" Have they "not suffered (enough) at the hands of what used to be called The Interests? Have the stewards of other people's money not made a hash of high finance? Where is the people's wrath?" In the wake of the "greatest (ever) failure of ratings and risk management."

Greenspan's Fed cut interest rates to 1%. "House prices levitated as mortgage underwriting standards collapsed." He claimed earlier that property appreciation was a sign of prosperity and a strong economy and "while home prices do on occasion decline, large declines are rare." Most homeowners experience "a modest but persistent rise in home values that is perceived to be largely permanent."

Especially, according to Grant, at a time that "credit markets went into speculative orbit, and an idea took hold. Risk....was yesterday's problem." It led to "one of the wildest chapters in the history of lending and borrowing." As a consequence, an $8 trillion home valuation wealth bubble and an unprecedented oversupply of unsold properties. Now in even more oversupply as owners default. Are foreclosed on or simply walk away from unaffordable underwater assets. They sit empty with no one to buy them except for those able in distressed sales.

The whole episode criminal and avoidable had the Fed used its authority under the 1994 Home Ownership and Equity Protection Act. It authorized the central bank to monitor abuses and intervene, if necessary, to prevent abusive lender practices. It failed to do it.

The result was predictable. People and the economy in crisis. Greenspan orchestrated it. His successor Bernanke did nothing to curb it. Wall Street was on a roll until it crashed. Huey Long once compared JD Rockefeller to "the fat guy who ruins a good barbecue by taking too much." Wall Street thrives on it. Fed largesse enables it. The problem is their indigestion affects everyone. A stomachache spreading round the world. How bad it'll get and where it stops nobody knows. Blame it on Greenspan. Our "former clairvoyant," according to Grant.

The New York Times - Uncharacteristically Critical

Usually a "free-market" cheerleader, even The New York Times voiced criticism. In an October 8 Peter Goodman article titled "Taking Hard New Look at a Greenspan Legacy." It quoted him in 2004 saying: "Not only have individual financial institutions become less vulnerable to shocks from underlying risk factors, but also the financial system as a whole has become more resilient."

As already explained, he abhorred regulation and championed derivatives. The latter what investor George Soros won't touch "because we don't really understand how they work." What long-time investment banker Felix Rohatyn calls potential "hydrogen bombs." What Warren Buffett describes as financial "weapons of mass destruction." What Alan Greenspan thought regulating would be a huge mistake and even today his faith in these instruments remains unshaken.

Others see things differently "and the role that Mr. Greenspan played in setting up (the current) unrest." Law professor Frank Partnoy says "derivatives are a centerpiece of the crisis." Given their purchased market value in the hundreds of trillions of dollars. Up from a fraction of that years back. The fact that much of it is toxic junk, and the fear that writing enough off will bankrupt their holders and send shock waves through world economies. They're already being felt. Especially in emerging markets.

None of this should have happened. "If Mr. Greenspan had acted differently during his tenure as Federal Reserve chairman, many economists say, the current crisis might have been averted or muted. Over the years, Mr. Greenspan helped enable an ambitious American experiment in letting market forces run free. Now, the nation is confronting the consequences."

It was argued throughout the 1990s "that derivatives had become so vast, intertwined and inscrutable that they required federal oversight to protect the financial system." Even so, "Mr. Greenspan banked on the good will of Wall Street to self-regulate as he fended off (suggestions of) restrictions."

As the housing bubble burst and prices began collapsing, "Mr. Greenspan's record has been up for revision. Economists from across the ideological spectrum have criticized his decision to let the nation's real estate market continue to boom with cheap credit, courtesy of low interest rates, rather than snuffing out price increases with higher rates."

He championed adjustable rate mortgages and ignored the clear fraud from subprime ones. In a 2004 speech, he said that "American consumers might benefit if lenders provided greater mortgage product alternatives to the traditional fixed-rate mortgage." He, in fact, endorsed the type abuses and the housing bubble they produced that Fed action should have prevented.

It will be a chapter in his legacy. Along with "the spectacular boom and calamitous bust in derivatives trading." He declined a Times interview request and referred instead to his record in his memoir, "The Age of Turbulence." In it, he stated that it's "superfluous to constrain trading in some of the newer derivatives and other innovative financial contracts of the past decade." Instead he "preached the transcendent, wealth-creating powers of the market." Not for Main Street. For Wall Street. What a friend of this writer calls "laissez-unfair."

Despite convincing evidence to the contrary, he claimed markets are best able to handle risks. Former Fed vice-chairman Alan Blinder said "Proposals to bring even minimalist regulation were basically rebuffed by Greenspan and various people in the Treasury. I think of him as consistently cheerleading on derivatives." In congressional testimony, he claimed the potential for serious crisis "extremely remote" and dismissively suggested that "risk is part of life." He also warned that too many rules would damage Wall Street and prompt traders to do business overseas.

Until the present, every debacle under him was resolved (enough at least) and markets stabilized and advanced. He got credit for his "steady hand at the Fed," and former Senator Phil Gramm said "You will go down down as the greatest chairman in the history of the Federal Reserve Bank." That comment may go down as the greatest misstatement in the history of the Senate.

This is the same Phil Gramm behind the 1999 Gramm-Leach-Bliley Act that repealed (1933 enacted) Glass-Steagall. It let commercial and investment banks and insurance companies combine and opened the door to rampant speculation, fraud and abuse.

In addition, the 2000 Commodity Futures Modernization Act (CFMA). At Gramm's behest, it was tucked undebated into an appropriations bill near the end of Clinton's tenure. It legitimized "swap agreements" and other "hybrid instruments" at the core of today's problems. It prevented regulatory oversight of derivatives and leveraging and turned Wall Street sharks loose on unsuspecting investors. Including world sovereign ones.

It also contained the "Enron Loophole." So the company could exploit its "Enron On-Line." The first internet-based commodities transaction system. Freeing electronic energy trading from regulation by rescinding supervisory restrictions in place since 1922. It empowered Enron to do as it pleased. Ended up fleecing investors. Bankrupting the company, and costing its employees their jobs and savings in worthless Enron stock. All because CFMA sailed through the House and Senate (below the radar), and Clinton signed it into law a month before he left office.

Much to Greenspan's approval. He sweet-talked Congress and said "There is a very fundamental trade-off of what type of economy you wish to have. You can have huge amounts of regulation and I will guarantee nothing will go wrong, but nothing will go right either." He added that Wall Street had tamed risk and "many of the larger (ones) are dramatically hedged." Legislators bought it or at least didn't object. The New York Times is less convinced. Better late than never but don't expect it to become a trend.

As Greenspan championed derivatives as a way of sharing risks, The Times said: "Shared risk has evolved from a source of comfort into a virus. As the housing crisis grew and mortgages went bad, derivatives actually magnified the downturn. In recent months, the financial crisis gathered momentum." Mr. Greenspan stayed conspicuously out of sight. Until October 23.

With the crisis unfolding, he wrote an epilogue to the paperback version of his memoir. Said "Risk management can never achieve perfection. Governments and central banks could not have altered the course of the boom." He has no regrets.

His critics do, and they're coming out of the woodwork, if slowly. Economist Jeff Sachs said "To a large extent, the US crisis was actually made by the Fed, helped by the wishful thinking of the Bush administration. One main culprit was none other than Alan Greenspan."

On October 24, the Seattle Times ran a piece on "Former hero Greenspan blamed for the credit crisis." He "found himself likened to one of the great goats of baseball." Called one of "three Bill Buckners." Referring to the 1986 Red Sox first baseman who let an easy ground ball through his legs that cost Boston the World Series as it turned out.

The Financial Times ran critical responses to a Greenspan article titled "We will never have a perfect model of risk" in which he argued for the inability to anticipate "all discontinuities in financial markets." Economics professor Paul de Grauwe called it "a smokescreen to hide his own responsibility in making the financial crisis possible."

Economist Michael Hudson challenged Greenspan's logic and misuse of empirical real estate data. Specifically land values. By spring 2006, "bankers knew there was a bubble." He wrote a Harpers cover story on it. But Fed officials compounded bad policy with more of it. Hudson added that "The financial system is now at a turning point. Bankers have shown that they can't regulate themselves when they're making so much money by feeding (off Fed created) bubble(s)."

Marx Was Right

According to David Cox before today's crisis emerged. In the London Guardian on January 29, 2007. He referred to globalization "laying bare the contradictions of capitalism" but extended the argument to "unbridled economic activity." Destroying "the world's climate, water supplies, farmland, forests and fish stocks." Additionally, "mountainous trading, governmental, corporate and personal debt threaten to precipitate world-wide economic collapse....Nothing but the re-engineering of global capitalism can head off the crisis that is beginning to confront it."

Fast-forward to now and the Guardian's "Maelstrom in the markets" article (September 16). Marx again featured. "It is a moment Karl Marx would have relished. From every angle financial capitalism is taking a battering....Two pillars of the modern economic system - greed and prosperity - are trembling in a manner unseen for a very long time."

On October 15, the Guardian headlined "Booklovers turn to Karl Marx as financial crisis bites in Germany. Karl Marx is back." According to German "publishers and bookshops who say that his works are flying off the shelves." Because people "recognise that the neoliberal promises of happiness have not proved to be true," according to publisher Karl-Dietz's Jorn Schutrumpf. Even Germany's finance minister, Peer Steinbruck, was chagrined enough to admit that "certain parts of Marx's theory are really not so bad."

He's on a "winning streak" others admitted, so it's worth noting what he wrote to Friedrich Engels: "The American Crash is a delight to behold and it's far from over." He referred to the Panic of 1857. An earlier banking crisis and recession that spread to Europe, South America and Asia.

Marx condemned "free-market" capitalism as "anarchic" and ungovernable. Because it alienates the masses. Prevents the creation of a humane society. Produces class struggle between the "haves" and "have-nots." The bourgeoisie (capitalists) and proletariat (workers). The destructive contradictions of the system. Exploited masses so a few can profit.

He predicted what's clear today. Competition over time produces a handful of winners. Powerful monopolies controlling nearly all production and commerce. Finance capitalism as well. Exploitation increases. Successive crises erupt, and ultimately fed up workers react. Recognizing their collective power and bringing down the system. Replacing it with a self-managed one. Ending exploitation and alienation. In his view, an inevitable socialist revolution.

His letter to Engels wasn't wrong. Just early, and perhaps by how change will evolve. Not the outcome. Just the method. With a whimper, not a bang. Not by workers. From the system's own corrosiveness. Internal contradictions. So unworkable. Crisis-prone. Fractured by inequities. So self-destructive it can't endure. So it won't. It will crumble on its own.

A Brief Update on Spreading Indigestion

Compared to other bouts, this one is scary and hitting everywhere. In his latest update, Nouriel Roubini states that:

"markets (are) in sheer panic and becoming literally dysfunctional and unhinged." So much so that "policy makers may soon (have to) close financial markets as the panic selling accelerates. Indeed, we have now reached a point where fundamentals and long term valuation considerations do not matter any more for financial markets. (They're in) free fall as most investors are rapidly deleveraging and we are on the verge of a capitulation collapse." Flows are now everything and in one direction. For the exits in a very destabilizing game.

Just as bad, economic fundamentals "are awful as investors are finally realizing that a severe US and Eurozone and G7 and emerging markets and global recession is coming (not a full-blown depression he believes) and will be deep and protracted." Before this ends, "equity prices may have to fall another 30% based on fundamentals alone...." Add the element of panic selling that may erase even more.

After Wall Street crashed in October 1929, the Dow lost 89% of its value by its low point in July 1932. No one today is predicting that. But given the current climate. Three decades of reckless excess. The greatest ever financial fraud. Multi-trillions of bad debt. Only the brave or foolish should imagine conditions won't be painful and protracted before they stabilize and improve.

What's sure is they're already awful, worsening, spreading, affecting everyone, and when finally ended - the world no longer will be the same as when the crisis emerged. But what it will look like and where it will head is anyone's guess.

For now, emerging economies are endangered. Iceland collapsed, and others, like Hungary, may have to default on their debt. More stable countries like India and Japan are also in trouble. For the first time in 26 years, Japan recorded a trade deficit as exports to the US dropped 21.8% from a year earlier. The steepest ever monthly decline. Recall also that at yearend 1989, Japan's Nikkei peaked at 38,915. It then plunged to 7831 in April 2003. On October 27, 2008, it sunk to a shocking 7163. About 18% of its peak value nearly 19 years earlier and its lowest valuation since October 1982. In the world's second largest economy. A hint of what may await the largest.

One money manager was so shaken he said we're "going back to the stone age." Across Asia it was bloody Friday. The same again on Monday and throughout the world. The worst on Friday was avoided. Armageddon was postponed until further notice. Beyond the timeline of this article, it may arrive sooner, not later.

Because markets are crashing. Equities, commodities, currencies, bonds considered risky. Anything investors can sell to raise cash. All signs are negative. In America, a key indicator is the Mortgage Bankers Association (MBA) figures on home loan applications. Its index tracking purchasing demand and for refinancing loans plunged 17% in its latest reading. Their lowest levels since October 2001 showing housing demand remains stubbornly weak and not likely to stabilize soon.

Other signs are just as worrisome. Fitch Ratings suggest that high-yield corporate debt defaults may end up the highest number on record. Hedge funds are hemorrhaging from forced liquidations and huge losses. US automakers are on their knees and may face bankruptcy. European ones are also wobbly. Credit is still frozen as who'll lend to borrowers who can't repay. And households are so over-indebted, they can't borrow nor will lenders accommodate them.

Global deleveraging is in play as well. According to Fitch Ratings, world credit growth peaked at almost 16% in 2007. By yearend, it will be 7% and lower still at 5% in 2009. Hardest hit will be "emerging Europe but (it) will spread to all regions." World recession is setting in. Most likely to be deeper, longer and worse than most predict.

In America, credit market debt as a percent of GDP began rising in the early 1980s and peaked at 350% in 2008. Comparable to its 1930s level. Money manager Jeremy Grantham's research shows that all markets revert to their means and generally way overshoot in the process. We're currently well into a massive repricing of risk and asset values. It may take years to play out. It will affect all over-valued markets. Stocks, bonds, commodities and leveraged debt. The cost will be in the trillions. The wreckage unimaginable. The result of monetary and fiscal irresponsibility with Greenspan deserving more blame than anyone.

In 1987, he was chosen to serve financial community interests. Largely Wall and major banks. He bailed them out on October 1987's black Monday. Again in 1998 after Long Term Capital Management's collapse. He flooded the market with easy money. Kept interest rates low. He could do no wrong, and even now, says he has "no regrets on any of the Federal Reserve's policies that we initiated." An astonishing statement given the gravity of today's crisis. The result of rampant speculation and fraud made possible by easy money. With Greenspan supplying it to all takers.

The Fed's job (or what it should be) is to promote stability. Smooth out the business cycle. Maintain a steady, healthy sustainable growth rate. Create price stability. Control inflation, and grow opportunities for everyone. Instead Greenspan fueled bubbles, and all he could say was that "irrational exuberance" may have "unduly escalated asset values" in a December 1996 speech. He did nothing to curb it. Claimed bubbles are hard to identify in real time, and the Fed is unable to diffuse them. He infamously said that it's "easier to clean up the mess after an asset bubble pops than to try and deflate (one) on the way up."

In fact, the Fed's job is to spot and moderate them. Not let them get out of hand. By raising interest rates. Margin requirements. Jawboning. Reducing the money supply to cool speculation and enhance stability. "Taking away the punch bowl," as former Fed chairman William McChesney Martin put it. Available tools Greenspan eschewed that would have worked if used. They weren't, and he denied all responsibility. The result is where we are today. Greenspan still avoiding a mea culpa and only expressing "shock" and "disbelief." But no regrets, and why not. His job was to transfer wealth from the public to the rich. In that he succeeded mightily but look at the cost.

-- markets crashing;

-- the economy sinking; in secular decline;

-- record budget and current account deficits;

-- a soaring national debt and federal obligations; $5 trillion alone in one day for the Fannie and Freddie takeover; hundreds of billions more so far and trillions more to come; taxpayers on the hook for it all;

-- rising personal and corporate bankruptcies;

-- mortgage loan delinquencies and defaults in the millions before this ends; the latest Realty Trac foreclosure filings survey reported default notices up 71% from third quarter 2007 and said figures likely were underestimated;

-- an unprecedented wealth gap;

-- record household debt and debt service levels as a percent of disposable income; around 25% of annual income to credit card companies alone;

-- the greatest housing crisis since the Great Depression;

-- flat wages;

-- high prices on basic items like food, fuel and health care;

-- rising unemployment; a wave of corporate-announced layoffs; across the board in nearly all sectors; biotech as well as banking; aerospace as well as autos;

-- conditions overall the worst in decades; maybe ever as things get more dire; how economist Paul Krugman (on October 26) described them in the words of a "guy who was told, 'Cheer up - things could be worse!' So he cheered up, and sure enough, things got worse."

The result of reckless and irresponsible policy. With lots of blame to go around. But none more than to the "maestro" of misery. Now 82 and unapologetic to the end.

© 2008 Stephen Lendman, Global Research

http://www.globalresearch.ca/index.php?context=va&aid=10708

The World Tires of Dollar Hegemony

by Paul Craig Roberts via reed - ICH Friday, Oct 31 2008, 7:56am

What explains the paradox of the dollar’s sharp rise in value against other currencies (except the Japanese yen) despite disproportionate US exposure to the worst financial crisis since the Great Depression?

The answer does not lie in improved fundamentals for the US economy or better prospects for the dollar to retain its reserve currency role.

The rise in the dollar’s exchange value is due to two factors.

One factor is the traditional flight to the reserve currency that results from panic. People are simply doing what they have always done. Pam Martens predicted correctly that panic demand for US Treasury bills would boost the US dollar.

The other factor is the unwinding of the carry trade. The carry trade originated in extremely low Japanese interest rates. Investors and speculators borrowed Japanese yen at an interest rate of one-half of one percent, converted the yen to other currencies, and purchased debt instruments from other countries that pay much higher interest rates. In effect, they were getting practically free funds from Japan to lend to others paying higher interest.

The financial crisis has reversed this process. The toxic American derivatives were marketed worldwide by Wall Street. They have endangered the balance sheets and solvency of financial institutions throughout the world, including national governments, such as Iceland and Hungary. Banks and governments that invested in the troubled American financial instruments found their own debt instruments in jeopardy.

Those who used yen loans to purchase, for example, debt instruments from European banks or Icelandic bonds, faced potentially catastrophic losses. Investors and speculators sold their higher-yielding financial instruments in a scramble for dollars and yen in order to pay off their Japanese loans. This drove up the values of the yen and the US dollar, the reserve currency that can be used to repay debts, and drove down the values of other currencies.

The dollar’s rise is temporary, and its prospects are bleak. The US trade deficit will lessen due to less consumer spending during recession, but it will remain the largest in the world and one that the US cannot close by exporting more. The way the US trade deficit is financed is by foreigners acquiring more dollar assets, with which their portfolios are already heavily weighted.

The US government’s budget deficit is large and growing, adding hundreds of billions of dollars more to an already large national debt. As investors flee equities into US government bills, the market for US Treasuries will temporarily depend less on foreign governments. Nevertheless, the burden on foreigners and on world savings of having to finance American consumption, the US government’s wars and military budget, and the US financial bailout is increasingly resented.

This resentment, combined with the harm done to America’s reputation by the financial crisis, has led to numerous calls for a new financial order in which the US plays a substantially lesser role. “Overcoming the financial crisis” are code words for the rest of the world’s intent to overthrow US financial hegemony.

Brazil, Russia, India and China have formed a new group (BRIC) to coordinate their interests at the November financial summit in Washington, D.C.

On October 28, RIA Novosti reported that Russian prime minister Vladimir Putin suggested to China that the two countries use their own currencies in their bilateral trade, thus avoiding the use of the dollar. China’s prime Minister Wen Jiabao replied that strengthening bilateral relations is strategic.

Europe has also served notice that it intends to exert a new leadership role. Four members of the Group of Seven industrial nations, France, Britain, Germany and Italy, used the financial crisis to call for sweeping reforms of the world financial system. Jose Manual Barroso, president of the European Commission, said that a new world financial system is possible only “if Europe has a leadership role.”

Russian president Dmitry Medvedev said that the “economic egoism” of America’s “unipolar vision of the world” is a ”dead-end policy.”

China’s massive foreign exchange reserves and its strong position in manufacturing have given China the leadership role in Asia. The deputy prime minister of Thailand recently designated the Chinese yuan as “the rightful and anointed convertible currency of the world.”

Normally, the Chinese are very circumspect in what they say, but on October 24 Reuters reported that the People’s Daily, the official government newspaper, in a front-page commentary accused the US of plundering “global wealth by exploiting the dollar’s dominance.” To correct this unacceptable situation, the commentary called for Asian and European countries to “banish the US dollar from their direct trade relations, relying only on their own currencies.” And this step, said the commentary, is merely a starting step in overthrowing dollar dominance.

The Chinese are expressing other thoughts that would get the attention of a less deluded and arrogant American government. Zhou Jiangong, editor of the online publication, Chinastates.com, recently asked: “Why should China help the US to issue debt without end in the belief that the national credit of the US can expand without limit?”

Zhou Jiangong’s solution to American excesses is for China to take over Wall Street.

China has the money to do it, and the prudent Chinese would do a better job than the crowd of thieves who have destroyed America’s financial reputation while exploiting the world in pursuit of multi- million dollar bonuses.

Author retains copyright.

http://www.informationclearinghouse.info/article21122.htm

<< back to stories

|