|

Secret Banking Cabal Emerges From AIG Shadows

by David Reilly via reed - Bloomberg Monday, Feb 1 2010, 7:50am

dreilly14@bloomberg.net

international /

imperialism /

other press

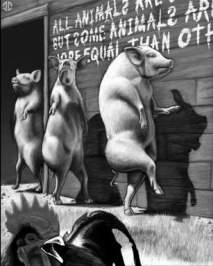

The idea of secret banking cabals that control the country and global economy are a given among conspiracy theorists who stockpile ammo, bottled water and peanut butter. After this week’s congressional hearing into the bailout of American International Group Inc., you have to wonder if those folks are crazy after all.

Wednesday’s hearing described a secretive group deploying billions of dollars to favored banks, operating with little oversight by the public or elected officials.

We’re talking about the Federal Reserve Bank of New York, whose role as the most influential part of the federal-reserve system -- apart from the matter of AIG’s bailout -- deserves further congressional scrutiny.

The New York Fed is in the hot seat for its decision in November 2008 to buy out, for about $30 billion, insurance contracts AIG sold on toxic debt securities to banks, including Goldman Sachs Group Inc., Merrill Lynch & Co., Societe Generale and Deutsche Bank AG, among others. That decision, critics say, amounted to a back-door bailout for the banks, which received 100 cents on the dollar for contracts that would have been worth far less had AIG been allowed to fail.

That move came a few weeks after the Federal Reserve and Treasury Department propped up AIG in the wake of Lehman Brothers Holdings Inc.’s own mid-September bankruptcy filing.

Saving the System

Treasury Secretary Timothy Geithner was head of the New York Fed at the time of the AIG moves. He maintained during Wednesday’s hearing that the New York bank had to buy the insurance contracts, known as credit default swaps, to keep AIG from failing, which would have threatened the financial system.

The hearing before the House Committee on Oversight and Government Reform also focused on what many in Congress believe was the New York Fed’s subsequent attempt to cover up buyout details and who benefited.

By pursuing this line of inquiry, the hearing revealed some of the inner workings of the New York Fed and the outsized role it plays in banking. This insight is especially valuable given that the New York Fed is a quasi-governmental institution that isn’t subject to citizen intrusions such as freedom of information requests, unlike the Federal Reserve.

This impenetrability comes in handy since the bank is the preferred vehicle for many of the Fed’s bailout programs. It’s as though the New York Fed was a black-ops outfit for the nation’s central bank.

Geithner’s Bosses

The New York Fed is one of 12 Federal Reserve Banks that operate under the supervision of the Federal Reserve’s board of governors, chaired by Ben Bernanke. Member-bank presidents are appointed by nine-member boards, who themselves are appointed largely by other bankers.

As Representative Marcy Kaptur told Geithner at the hearing: “A lot of people think that the president of the New York Fed works for the U.S. government. But in fact you work for the private banks that elected you.”

And yet the New York Fed played an integral role in the government’s bailout of banks, often receiving surprisingly free rein to act as it saw fit.

Consider AIG. Let’s take Geithner at his word that a failure to resolve the insurer’s default swaps would have led to financial Armageddon. Given the stakes, you might think Geithner would have coordinated actions with then-Treasury Secretary Henry Paulson. Yet Paulson testified that he wasn’t in the loop.

“I had no involvement at all, in the payment to the counterparties, no involvement whatsoever,” Paulson said.

Bernanke’s Denials

Fed Chairman Bernanke also wasn’t involved. In a written response to questions from Representative Darrell Issa, Bernanke said he “was not directly involved in the negotiations” with AIG’s counterparty banks.

You have to wonder then who really was in charge of our nation’s financial future if AIG posed as grave a threat as Geithner claimed.

Questions about the New York Fed’s accountability grew after Geithner on Nov. 24, 2008, was named by then-President- elect Barack Obama to be Treasury Secretary. Geither said he recused himself from the bank’s day-to-day activities, even though he never actually signed a formal letter of recusal.

That left issues related to disclosures about the deal in the hands of the bank’s lawyers and staff, rather than a top executive. Those staffers didn’t want details of the swaps purchase to become public.

New York Fed staff and outside lawyers from Davis Polk & Wardell edited AIG communications to investors and intervened with the Securities and Exchange Commission to shield details about the buyout transactions, according to a report by Issa.

That the New York Fed, a quasi-governmental body, was able to push around the SEC, an executive-branch agency, deserves a congressional hearing all by itself.

Later, when it became clear information would be disclosed, New York Fed legal group staffer James Bergin e-mailed colleagues saying: “I have to think this train is probably going to leave the station soon and we need to focus our efforts on explaining the story as best we can. There were too many people involved in the deals -- too many counterparties, too many lawyers and advisors, too many people from AIG -- to keep a determined Congress from the information.”

Think of the enormity of that statement. A staffer at a body with little public accountability and that exists to serve bankers is lamenting the inability to keep Congress in the dark.

This belies the culture of secrecy obviously pervasive within the New York Fed. Committee Chairman Edolphus Towns noted during the hearing that the bank initially refused to disclose even the names of other banks that benefited from its actions, arguing this information would somehow harm AIG.

‘Penchant for Secrecy’

“In fact, when the information was finally released, under pressure from Congress, nothing happened,” Towns said. “It had absolutely no effect on AIG’s business or financial condition. But it did have an effect on the credibility of the Federal Reserve, and it called into question the Fed’s penchant for secrecy.”

Now, I’m not saying Congress should be meddling in interest-rate decisions, or micro-managing bank regulation. Nor do I think we should all don tin-foil hats and start ranting about the Trilateral Commission.

Yet when unelected and unaccountable agencies pick banking winners while trying to end-run Congress, even as taxpayers are forced to lend, spend and guarantee about $8 trillion to prop up the financial system, our collective blood should boil.

© 2010 Bloomber L.P.

http://www.bloomberg.com/apps/news?pid=20601039&sid=aaIuE.W8RAuU

<< back to stories

|