|

Wall Street Banksters Feeling Heat

by red Thursday, May 10 2012, 11:59pm

international /

imperialism /

commentary

Jail 'em for Fraud and Manipulating Commodities Markets

Deserving of all the contempt and hostility the public directs at criminal Wall St Banksters, JP Morgan, Goldman Sachs etc., chief honcho of JP Morgan, Jamie Dimon, openly apologised for wrong doings – “self inflicted mistakes” (O, really!) -- and admitted that certain practices the Bank engaged in were unprincipled – understatement of the year!

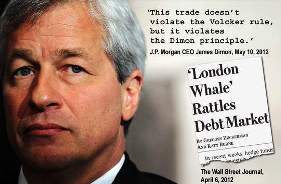

Jamie Dimon, rogue Bankster

Never mind the fact that not a cent of personal executive spoils has ever been returned to the public in a gesture of good faith, or the ($) trillions in odorous profits and taxpayer BAILOUTS that remains in bank coffers, Dimon says 'sorry!' Well, blow it out your arse, the breath you feel on your stinking Jew neck is mine and the nightmares you have of lynch mobs stringing up Wall Street Bankers are prophetic -- If you can’t see it coming you’re as BLIND as you are GREEDY!

How dare you [Dimon] make hot air apologies without any attempt at RESTITUTION/REPAYMENT of the trillions in misappropriated funds and losses, you filthy, thieving, slime bag -- TAKE RESPONSIBILITY and PAY! Tell it to your Jew mates at Goldman Sachs, your time is coming to an E-N-D!

Read the following piece from the WSJ and pay particular attention to the roulette, gambling LANGUAGE these rogues use. We work HARD for every cent and they BET in billions of OUR dollars. Banking and Finance sectors MUST be tightly regulated in order to protect the interests of the public and protect the GLOBAL economy, that is OBVIOUS, puppet Obama:

J.P. Morgan's $2 Billion Blunder

A massive trading bet boomeranged on J.P. Morgan Chase JPM +0.25% & Co., leaving the bank with at least $2 billion in trading losses and its chief executive, James Dimon, with a rare black eye following a long run as what some called the "King of Wall Street."

The losses stemmed from wagers gone wrong in the bank's Chief Investment Office, which manages risk for the New York company. The Wall Street Journal reported early last month that large positions taken in that office by a trader nicknamed "the London whale" had roiled a sector of the debt markets.

The bank, betting on a continued economic recovery with a complex web of trades tied to the values of corporate bonds, was hit hard when prices moved against it starting last month, causing losses in many of its derivatives positions. The losses occurred while J.P. Morgan tried to scale back that trade.

The bank's strategy was "flawed, complex, poorly reviewed, poorly executed and poorly monitored," Mr. Dimon said Thursday in a hastily arranged conference call with analysts and investors after the stock-market close. He called the mistake "egregious, self-inflicted," and said: "We will admit it, we will fix it and move on," he said.

The trading loss "plays right into the hands of a whole bunch of pundits out there," Mr. Dimon said. "We will have to deal with that—that's life."

Asked about the Volcker rule, he said, "This doesn't violate the Volcker rule, but it violates the Dimon principle."

J.P. Morgan shares fell about 6.5% to $38.09 in after-hours trading. Citigroup C +0.66% was off about 3.6%, SunTrust STI +2.21% 3.3%, Fifth Third Bancorp 2.7%,

Bank of America BAC -0.39% 2.6%, Morgan Stanley MS +0.71% 2.5% and Goldman Sachs GS -0.90% 2.4%.

J.P. Morgan, the nation's largest bank by assets, said in its quarterly filing with regulators Thursday that the plan it has been using to hedge risks "has proven to be riskier, more volatile and less effective as an economic hedge than the firm previously believed."

It slashed its estimate for the unit that houses the Chief Investment Office to $800 million in second-quarter losses from a previous estimate of $200 million in profits. Mr. Dimon said the trading losses were "slightly more" than $2 billion so far in the second quarter.

A person close to the bank said the current loss is actually $2.3 billion.

The losses have been offset by about $1 billion in gains on securities sales. Mr. Dimon said "volatility" in markets could cost the bank an additional $1 billion this quarter.

The Journal reported in April that hedge funds and other investors were making bets in the market for insurance-like products called credit-default swaps, or CDS, to try to take advantage of trades done by a London-based trader named Bruno Michel Iksil who worked out of the Chief Investment Office, or CIO.

Mr. Dimon said on the company's first-quarter earnings call April 13 that questions about the office's trading were "a complete tempest in a teapot." The CEO didn't learn of the full extent of the losses until after that earnings call on April 13, said a person familiar with the situation.

On Thursday he admitted the bank acted "defensively" when news reports surfaced. "With hindsight we should have been paying more attention to it," he said. "This not how we want to run a business."

Mr. Iksil is still at the bank, said people close to the bank. He didn't respond to an email requesting comment.

People within the CIO group, which has been under the radar at J.P. Morgan and not well understood by analysts following the company, were long aware Mr. Iksil had built derivative positions with a face value of $100 billion or more.

Mr. Dimon was regularly briefed on details of some of the group's positions, according to several people close to the matter, suggesting he too overlooked the potential risks of the trade.

The CIO group once had a large trade designed to protect the company from a downturn in the economy. Earlier this year, it began reducing that position and take a bullish stance on the financial health of certain companies and selling protection that would compensate buyers if those companies defaulted on debts.

Mr. Iksil was a heavy seller of CDS contracts tied to a basket, or index, of companies. In April the cost of protection began to rise, contributing to the losses.

Mr. Iksil's group had roughly $350 billion of investment securities at Dec. 31, according to company filings, or about 15% of the bank's total assets.

J.P. Morgan's investment bank's "value-at-risk," a measure of how much money it stands to lose on a given day, nearly doubled in the first quarter, according to the filing Thursday. It rose to an average of $170 million from $88 million a year earlier.

Risk-taking was driven largely by positions taken in the CIO group, said the company. The value-at-risk for that division averaged $129 million in the first quarter, more than double a year earlier. The bank attributed the jump to "changes in the synthetic credit portfolio held by CIO."

"This is yet another example of the need for the more than $700 trillion derivatives market to be brought into the light of financial regulation," said Dennis Kelleher, president of Better Markets, a liberal nonprofit focused on financial reform.

The losses could potentially expose bank employees to so-called clawback policies that permit the recovery of compensation in the event of a financial restatement. Banks like J.P. Morgan have adopted such policies, which also are required under the Dodd-Frank financial overhaul law.

Mr. Dimon said the bank has an extensive review under way of what went wrong, which he said included "many errors," "sloppiness" and "bad judgment."

Asked what, in hindsight, he should have paid more attention to, Mr. Dimon deadpanned: "newspapers."

© 2012 Dow Jones & Company, Inc

http://online.wsj.com/article/SB10001424052702304070304577396511420792008.html COMMENTS show latest comments first show full comment text

<< back to stories

|