|

'See how they run,' house of (derivative) cards ready to collapse!

by nano - The Daily Mail Friday, Oct 10 2008, 4:46am

international /

social/political /

commentary

EU disintegrating

From the absolute theocratic rule of Pharaohs through Rome’s military elites to the economic theorists of the modern era (Marx/Friedman) the failure of social groups and societies has less to do with flawed models than with ‘human frailty!’ Call it what you will but I prefer calling a spade a spade -- pig selfishness, greed and no regard for the less fortunate other.

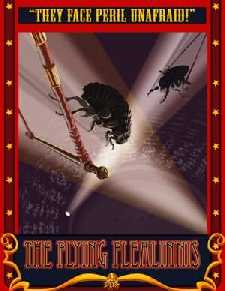

Flea pedalling

Corruption and man’s lower nature have been responsible for the demise of powerful empires and the most enlightened societies in history. So let’s take a timely look at the cause, not the effects. [The human race must decide whether it has more in common with farmyard pigs or with poets/philosophers/creative artists and idealists!]

Socialism and its bastard child, communism, failed due to CORRUPTION and man's insensitivity to man. Capitalism has had its jugulars cut by exactly the same human flaws. No sooner do puppet governments and Federal Banks release HUGE amounts of 'bailout' money than it ‘vaporises’ or disappears in the pockets of the few – it’s every PIG for himself and fuck YOU Jack, cos I’m smarter, faster and better connected than you! That is the long and short of it! You weren’t smart enough to catch me then -- you have no hope now!

History also records that people often rebelled; one rotten ruling elite was simply replaced with another – it is the nature of the beast and it's positively laughable listening to the thin rhetoric 'justifying' the huge bailouts today! “See how they run,” indeed!

Amid all the current ‘news' headlines, 'expert' discourse and the babbling of mindless journos, ONE report stands in stark contrast to the rest. It’s oblique perspective revealed some basic home truths and facts about our essential nature. Read it, but be mindful of the sub-text which rubs our snouts in the human condition. From the Daily Mail:

The financial crisis could be the Euro's death knell ... and even end the shambolic EU

by Christopher Booker

Updated 1:42 AM on 8th October, 2008

At the very moment when Europe's banking system is teetering on the edge of collapse and national economies are in freefall, we might, perhaps, have expected the EU finally to live up to its more grandiose pretensions as the ' government of Europe'.

Yet what have we seen by way of the EU's response to what is undoubtedly the most testing crisis in its history?

A few perfunctory fine words and empty gestures - and then the national leaders flapping off like so many headless chickens to pursue their own national interests, regardless of all those laws and principles which in easier times they were apparently so happy to sign up to.

The truth is that this massive banking crisis has exposed the hollowness, the impotence and the hypocrisy of the European Union like nothing before in its history.

This present emergency is the first real ordeal that the euro - that supposed symbol of European economic unity - has had to face as a major international currency.

Yet, without a central united government to give it proper political clout, it has seemed strangely irrelevant to a financial meltdown that has seen all the 13 countries which use it more concerned about their own national economies than a supranational currency.

The fact is that when a crisis occurs, we are all concerned about our own nation - not our neighbours.

But what is doubly worrying about the EU in the current crisis is not just the questions it raises over the single currency, but the spectacular inability of the whole creaking edifice to respond in any meaningful way.

First, last week, we saw Nicolas Sarkozy of France, as the EU's acting president, calling for an EU-sponsored bail-out of its banks, in pale emulation of the attempted bail-out of the U.S. banking system which was dominating the world's headlines - an empty political gesture which melted away almost as soon as he had proposed it.

Then we saw the Irish government, faced with the imminent collapse of its own major banks, pledging a 100 per cent state-backed guarantee of all customers' deposits.

This was in flagrant breach of EU law, but it just happened that the Brussels commissioner in charge of financial services was Charlie McCreevy, an Irishman who cheerfully observed that he could see no problems with his country's scheme.

On Saturday, President Sarkozy invited Chancellor Angela Merkel of Germany, Prime Minister Silvio Berlusconi of Italy and Gordon Brown to Paris for an 'emergency summit' to discuss the crisis.

'It is of the essence,' said Mr Sarkozy, 'that Europe should exist and respond with one voice.'

This, in itself, was odd enough. Why were only these four governments represented - along with the president of the European Central Bank, the man in charge of the euro?

What about the leaders of the other 23 countries making up the EU, many of whom were deeply disturbed at being excluded from this cosy get-together?

It was far from clear that anything emerged from Mr Sarkozy's summit other than their alarm at the precedent set by the Irish government in guaranteeing those bank deposits, which had already led to a drain of billions of pounds into Irish banks from countries which did not offer their customers such protection.

And what happened next, when Chancellor Merkel scurried back to Berlin to find the German banking system on the edge of its own meltdown?

First, she shocked her EU colleagues by appearing to offer an Irish-style guarantee to all the customers of Germany's banks.

Then, as Denmark and Austria jumped to follow suit, it emerged that Mrs Merkel was backtracking on her proposal. Chaos swiftly descended into farce.

So what on earth is going on? What does all this shambles tell us about the EU, the whole point of which was to set up a supranational government designed to allow Europe to speak with 'one voice' and armed with a mass of laws and treaties to ensure that nation states could no longer operate on their own to pursue their own selfish national interests?

The contrast has already been drawn between what we saw in America last week when day after day, amid the full glare of publicity, Congress agonised over whether or not it should pass that famous bail-out Bill.

At least that was democracy visibly in action, as senators and congressmen were besieged by their constituents urging them to vote one way or the other.

All we could offer in Europe was the spectacle of four national leaders briefly huddled together behind closed doors in Paris, without even a proper communique to tell us what they had discussed.

As every day passes, it becomes ever more obvious not just that the much-vaunted 'European monetary union' system is wholly incapable of providing any solution to this crisis, but that the crisis might itself be the trigger to the cracking apart of the entire structure.

Astonishingly, it was only yesterday, when the EU's 27 finance ministers gathered for an emergency meeting in Luxembourg, that we saw the EU's first concerted attempt to respond to the crisis.

And top of their agenda was a little-noticed issue which has put the EU in the hot seat as not so much a potential saviour but as having been itself a major contributory cause of the crisis in the first place.

Right at the heart of the paralysis which has gripped the banking systems of the Western world has been a new set of rules which came into force last year, drastically tightening up on the ability of banks to lend to each other - the very lifeblood of the banking system.

It is this freezing of liquidity which more than anything has triggered the present crisis, as has been widely recognised in America, which is why last week's Congressional Bill approved the suspension of the rules which are creating so much havoc.

But what did the EU ministers in Luxembourg agree yesterday? Well, they, too, agreed it was a top priority that these disastrous new rules should be suspended. But that is not enough to mean they will be suspended.

No. First, the ministers' proposals will have to win the agreement of the full European Council when it meets next week and then they will have to go through all the tortuous procedures involved in changing the directives by which the new rules were made the law of the EU.

The whole process could take months and meanwhile economies are collapsing.

While every other nation is free to pursue its own agenda, it seems that we are at the mercy of a secretive, cumbersomely bureaucratic system of government which is wholly incapable of mounting a flexible, effective response to the challenge.

The fate of the euro is key to the future of the European dream.

Those countries most passionate about creating a 'United States of Europe' established the euro ten years ago as the supreme symbol of their desire to weld Europe together in full 'economic and monetary union'.

As we face a crisis as serious as most of us have seen in our lifetimes, it might not be just the euro which falls apart, but that entire over-ambitious experiment in supranational government which the EU represents.

Our banks might be tottering, but it might eventually be the EU itself, which falls.

© 2008 Associated Newspapers Ltd

It is very difficult resisting cynicism these days. The prospect of marauding masses keeps me going (little joke!) Have you ever seen fleas maraud?

Frontmen, Bernanke and Paulson -- trust us, yea, sure!

http://www.dailymail.co.uk/news/article-1072416/CHRISTOPHER-BROOKER.html

<< back to stories

|